XAG/USD trades below the three-week high level of $22.00

- Silver slides after reaching a March high, following a significant increase not seen since early November 2022.

- XAG/USD starts the day with a lower open price of $20.54 before climbing to an intraday price of $21.70.

- The price movements are relatively narrow, with the highest and lowest intraday prices being $21.92 and $21.62, respectively.

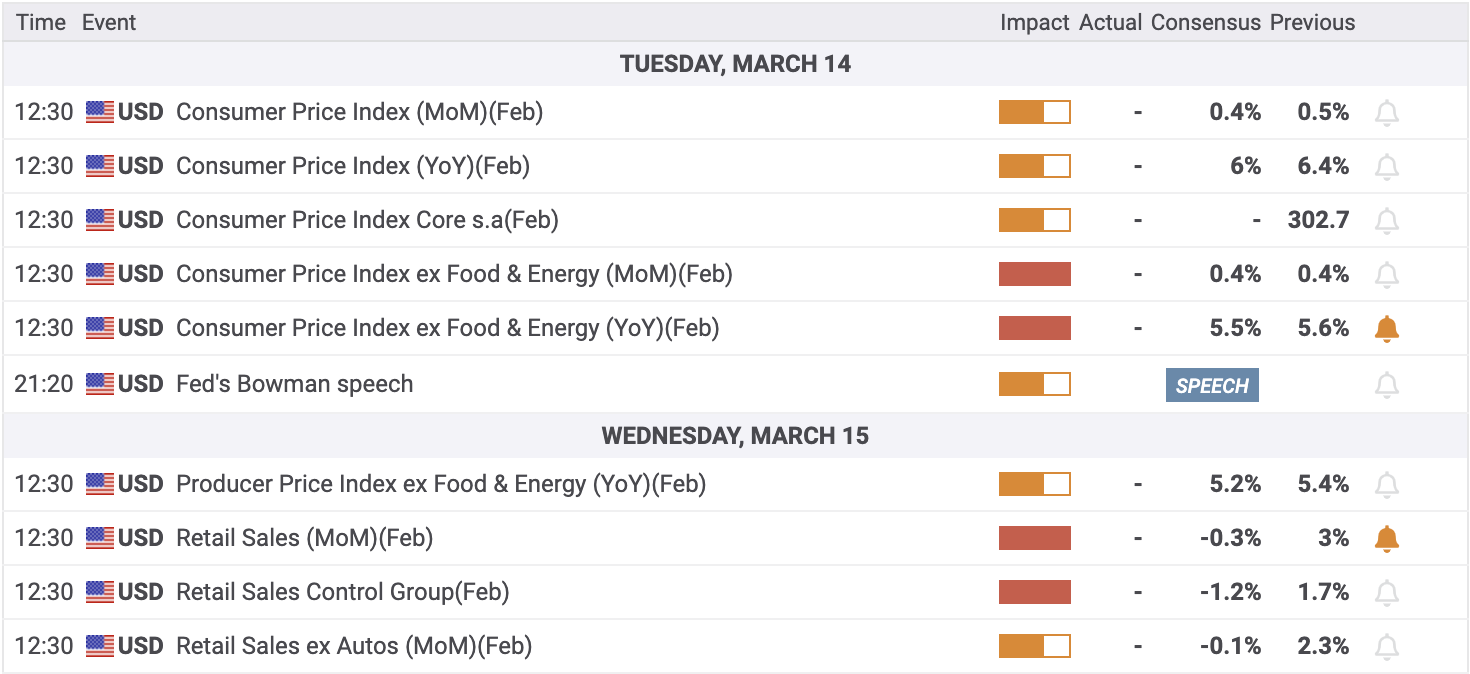

- Traders cautiously watch Tuesday’s US CPI and Wednesday’s US Retail Sales data.

Daily price movements:

Silver (XAG/USD) starts the day on a slightly bearish note, with a lower open price of $20.54 compared to the close price of the previous day. However, the XAG/USD currency pair climbs back up and trades at $21.70, still 0.47% down from its previous close of $21.81 at the press time, with a narrow intraday price range of $21.92 to $21.62. The market sentiment remains mixed ahead of Tuesday’s US inflation data.

After Silicon Valley Bank's (SVB) collapse, the banking sector's condition has raised concerns, leading to a decrease in expectations for a rate hike by the Federal Reserve (Fed). Investors are watching how this crisis and US Inflation data – to be announced on Tuesday at 15:30 GMT – could impact.

Key economic events:

US February Consumer Price Index (CPI) (Feb) on Tuesday at 12:30 GMT and US February Retail Sales on Wednesday at 12:30 GMT are crucial for monetary expectations and are closely watched. However, the unfortunate SVB collapse has resulted in markets anticipating a more lenient stance by the Federal Reserve (Fed).

Technical view:

The daily chart shows XAG/USD trades above its 20-SMA of $21.05, indicating a short-term bullish trend. However, it is still below its daily 50-SMA of $22.36, suggesting a longer-term bearish bias. RSI(14) is at 59.43 at the time of press, indicating a buying stance.

The daily pivot point is $21.43, with daily resistance levels at $22.32, $22.82, and $23.71, and daily support levels at $20.93, $20.04, and $19.54.

Traders are advised to carefully monitor price movements ahead of the US inflation data and use appropriate risk management strategies.